BUDGET 2013 – Significant Motor Tax increases

Motor Tax increases across the Board

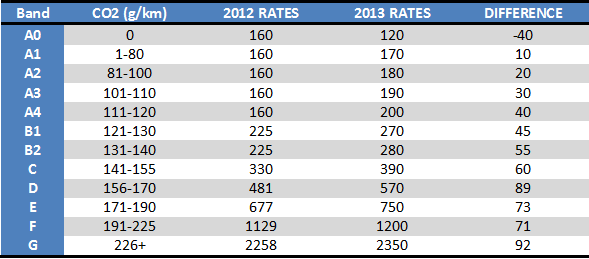

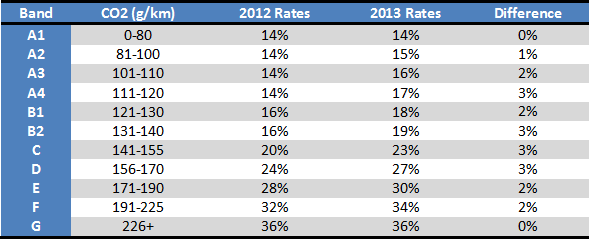

Budget 2013 saw Minister Noonan announce significant motor tax increases across the board for all vehicles – encompassing both the new and the old motor tax regimes. The changes had been flagged in the run up to the budget, and Cartell had made calculations on the extent of the extra revenue the Minister was likely to yield. However, the announcement on Budget day itself will still come as a shock to many motorists. Making the announcement the Government state: “The higher rate of increase in motor tax for cars taxed on the basis of CO2 reflects the comparatively lower rate of tax for these cars compared to those taxed on the basis of engine capacity”. This shows the Government are intent on rowing back significantly on advantages yielded to low CO2 emission vehicles.

Taxation Rates

VRT changes

VRT will also increase with increases broadly consistent with those seen in the 2013 CO2 Motor Tax regime: i.e. VRT Band A and B have been adjusted with the introduction of sub-bands in each while general increases apply across the board.

Registration Period Revised

2013 will see the introduction of a second registration period, or bi-annual registration system. This was to cede to concerns within the motor industry to change the plate system to protect jobs by encouraging the sale of new cars more evenly throughout the year. Any new car bought in the first six months of 2013 will have their new registration plate start 131; and 132 will apply where the vehicle is bought between 1st July and 31st December.

Consultation Process

The consultation process before the announced changes today involved representatives of the Department of Finance, the Revenue Commissioners, the Department of the Environment, Community and Local Government and the Department of Transport, Tourism and Sport reviewing the submissions received and conducting a number of follow-up meetings to investigate further some of the proposals. The Government says the views of industry were carefully considered throughout the process.