Important VRT Update 2021

Note: Before using the VRT Calculator please be aware that from 1 January 2021, a new table for calculating VRT on motor vehicles will apply based on a CO2 emissions test for passenger cars, known as Worldwide Harmonised Light Vehicle Test Procedure (WLTP). The existing 11 band table for VRT is to be replaced with a 20 band table with a revised rates structure. The new VRT rates will range from 7% to 37% compared to a current range from 14% to 36%. A formula will be used to calculate VRT under the new regime for used vehicles that were subject to the current New Europe Driving Cycle (NEDC) emissions test. Most of the used vehicles imported into Ireland are from the United Kingdom. The UK Driving Vehicle and Licensing Authority (DVLA) have confirmed to our UK data partner that “it started capturing WLTP CO2 (g/km) in September 2018 where available, but only started outputting to the V5C for M1/M1G vehicles in April 2020”. It is therefore safe to deduct that from April 2020 the V5 will have WLTP CO2 (g/km) stated. However there is ambiguity surrounding vehicles from September 2018 as to whether some are WLTP or NEDC rated. The new VRT rules for 2021 propose that NEDC CO2 (g/km) on imported vehicles is increased to that of WLTP CO2 (g/km).

Cartell is seeking clarity and investigating the effect a mixed CO2 (g/km) could have on the VRT Calculator and in particular the Stat Codes defined by Revenue. This coupled with a potential hard Brexit is providing uncertainty in the online VRT process. Therefore Cartell has taken the decision to suspend the VRT calculator from January 1, 2021. The intention is to reinstate the calculator after thorough testing, verification and confirmation. We recommend any customer wishing to import a car from the UK January 1 contact the Revenue Commissioner or NCTS directly.

For Cartell trade customers the services affected are:

· VRT Calculation section will be paused in our HPI UK reports.

· Our “VRT and MIAFTR” Trade Report will be disabled.

· All VRM/XML/JSON mappings to Statcodes will be return no data.

We will of course update you further when our new VRT calculator is ready for use.

VRT Ireland

Vehicle Registration Tax (VRT) is a tax you must pay when first registering a motor vehicle in Ireland.

VRT is based on the Open Market Selling Price (OMSP) of the vehicle. The OMSP depends on the market value, engine size, year, model and roadworthiness condition of the vehicle.

If you are considering importing a vehicle from the UK, we strongly advise a Complete Cartell Check which will provide an entire history report including; Mileage Check, Finance Check, Write-Off Check, MOT History, and more!

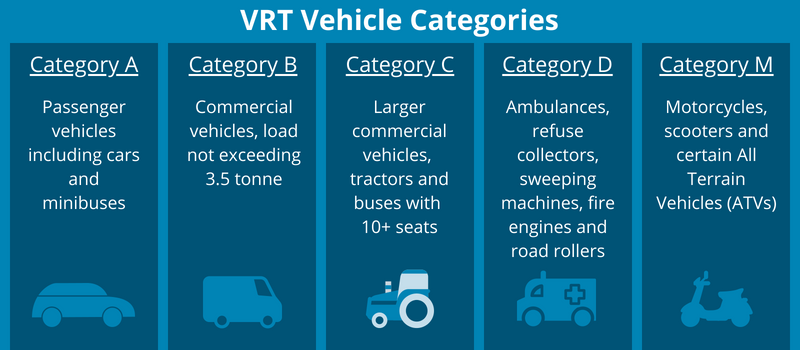

VRT Vehicle Categories

Vehicles are placed into categories before the amount of tax payable is calculated by Revenue. There are 5 categories, VRT category A, B, C, D and M.

VRT Category A

Category A includes passenger vehicles (saloons, estates, hatchbacks, convertibles, coupes, MPVs, Jeeps etc.) and minibuses. The minibuses cannot carry more the eight people and a driver.

These vehicles are generally European category M1, but can also contain certain category N1 vehicles which have four or more seats.

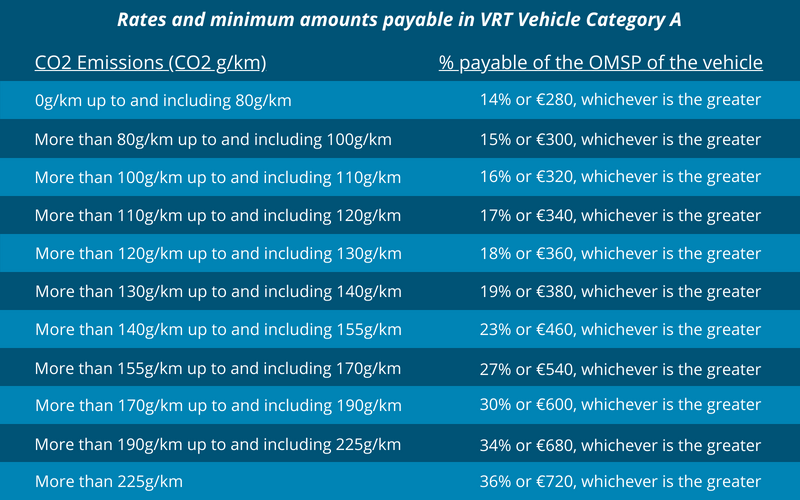

The VRT due is generally the OMSP multiplied by the VRT rate, though minimum values also apply. The rates and minimum amounts payable in VRT Category A are as follows:

VRT Category B

Category B includes motor caravans and commercial vehicles designed for the transport of goods (less than 3.5 tonnes).

These vehicles are European category N1 and generally have three seats or less.

The VRT is generally 13.3% of the OMSP and the minimum due is €125.

Customers who completed Cartell Checks have experienced instances where Jeeps were categorized as Category A but should have been Category B. Therefore, these vehicle owners may have paid up to 22% extra VRT.

VRT Category C

Category C includes larger commercial vehicles, agricultural tractors and buses with a minimum of 10 seats including the driver’s seat.

These vehicles include European category N2 vehicles (over 3.5 tonnes and under 12 tonnes in weight), N3 vehicles (over 12 tonnes in weight), M2 vehicles (under 5 tonnes in weight, with a minimum of 10 seats including the driver’s seat) and M3 vehicles (over 5 tonnes in weight, with a minimum of 10 seats including the driver’s seat).

VRT Category C vehicles are subject to a €200 charge.

VRT Category D

Category D vehicles include ambulances, refuse collectors, sweeping machines, fire engines, road rollers and vehicles used exclusively for the transport of road construction machinery.

Category D vehicles are not subject to VRT.

VRT Category M

Category M contains motorcycles, scooters and certain All Terrain Vehicles. The cubic capacity (cc) of the engine determines the VRT charge.

These vehicles are classified under European category L1 to L7.

NOTE: All above information is accurate as of the 22/08/2018, courtesy of Revenue.ie.

Stay up to date

Make sure you’re following Cartell on Facebook, Twitter, Instagram and Linked In for the latest news and Cartell.ie promotions.